The Benefits of Mobile Wallets for Parking

This is the first part in a series discussing the benefits of one of the most impactful, but least understood technologies in the parking industry: the Mobile Wallet.

The mobile wallet is the definitive untapped technology in the parking industry today. The mobile wallet is powerful, first and foremost, because it directly contributes to a healthier bottom line by creating significant and measurable merchant processing savings for parking operators. These savings can be in the millions for some larger parking operations.

This post was spurred on by the lack of wallet adoption in the parking industry. What’s most surprising about the lack of wallets in parking is that stored value accounts are not new to the industry. They were first introduced in the form of meter smart cards (one could even argue the parking token was a form of a wallet). Stored value accounts on smart cards allowed users to pre-fund their account with a larger payment and draw down upon the account over time. That is essentially a mobile wallet in a physical form.

This pre-fund and draw-down approach is very important to the parking industry because the industry relies on micro payments. These small payments present a large problem to operators and owners in the parking industry because they cost so much money to manage in terms of merchant processing. I’m positive that there are cases in our industry where more than 100% of the revenue collected on some transactions is going to merchant processing. Let me explain why.

Merchant processing companies typically charge a flat fee plus a percentage of revenue collected. Let’s look at the pricing at 2 major merchant processors, Braintree and Stripe. Both prominently advertise a 2.9% + $0.30 fee:

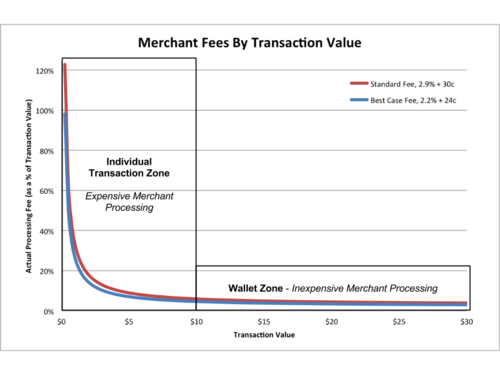

2.9% and $0.30 may work well on a $20 transaction – coming to $0.88, or 4.4% of the transaction, but it has the opposite effect on a small payment in parking. That’s due to the large fixed fee of $0.30. Let’s go to the extreme, and say you park for a quarter. 2.9% and $0.30 on a $0.25 parking transaction. The 2.9% charge only costs you a penny, but the fixed $0.30 fee is imposed on every payment, no matter how small. So you just paid your merchant provider 31 cents to collect 25 cents. That’s a 24% loss caused entirely by merchant processing fees. You would have been better off if the parking customer hadn’t paid at all! On a $0.50 transaction you’ll end up with the same fee of 31 cents, which ends up costing you 62% of your revenue for that transaction. The math goes on. See the chart below for the details, but the gist is that you need to increase your average payment size in order to minimize the disproportionate effect of the fixed processing fee on micro payments.

You may argue, “But we have the best fees in the industry!”

Even if you are right, the problem still exists.

Take a look at the chart above. Do you see any discernable difference in the low cost and high cost merchant processing fees? One is the standard market rate and the other is your “best case” merchant fees scenario. Both scenarios lead to the same conclusion: smaller payments are disproportionately affected by merchant processing fees. You will find that merchant processing on small transactions is expensive for both hardware-based transactions (card present) and mobile transactions (card not present). The difference is mobile has the solution that hardware could never provide: The ability to create mobile wallets.

Hardware providers tried their best with smart card solutions and should be lauded for their efforts, but the hardware solutions did not work. The problem with smart cards (and potentially tokens) is the provisioning process. It’s a nightmare. Parkers don’t want to come into an office to pick up a card or tokens, and the operator doesn’t want to deal with the hassle if they actually do come in.

Luckily for all, the antidote for exorbitant merchant processing costs has arrived. Mobile Wallets solve the problem and they’re easy to implement.

Let’s look at an example of a large municipal operator, just to exhibit the benefits of using mobile wallets. Let’s say you have 3000 on-street spaces, and a typical rate structure of $1.00 per hour, with a 2 hour max. You have just implemented mobile payments, even though your hardware takes credit card payments. Nice work!

What do the savings look like for you?

The Setting

Spaces: 3000

Rate: $2.00 per hour

Max Stay: 2 hours

Some Well Educated Assumptions

Average Stay: 1 hour

Average Turnover: 1000 transactions per space per year

Percentage of Credit/Debit Card Transactions: 60%

The Totals

Total Transactions: 3,000,000 per year

Average Fee Collected: $2.00

Total Fees Collected: $6,000,000 ($2.00 per transaction)

Merchant Processing Fees

Total Credit/Debit Card Transactions: 1,800,000 per year

Total Merchant Processing Revenue Collected: $3,600,000 per year

Average Merchant Processing Fee: $0.36 ($2.00 * 2.9% + 30c)

Without a Wallet

Total Merchant Processing Fees: $648,000 per year

Now let’s add a mobile wallet, and assume everyone exchanges those credit and debit card transactions for wallet transactions.

New Metrics

Average Wallet Load: $20

Merchant Processing Fee per Wallet Load: $0.94 ($20 * 2.9% + 30c)

Average Fee Collected: $2

Transactions per Wallet Load: 10

The New Totals

Effective Merchant Processing Fee: 9.4 cents ($0.94/10 - ie the total merchant fees on the $20 wallet load divided by the number of transactions it could be used for)

Wallet Transactions per Year: 1,800,000 (same as above)

With a Wallet

Total Merchant Processing Fees Per Year: $169,200

That’s a savings of $478,800 per year!

It should be very apparent that a successful mobile wallet can create significant benefits for the parking operator here. Any time you can guarantee your operation a savings this significant, you should jump on it. And as was mentioned earlier, this financial benefit is just one of the many benefits of a mobile wallet. Stay tuned for the next post in what I hope is a helpful informational on mobile wallets for parking.

By Charlie Youakim, Managing Partner at Passport.

Comments

There are no comments yet for this item

Join the discussion